India’s GST Regime (GST) system, introduced on July 1, 2017, represents one of the most significant tax reforms in the country’s history. It replaced a multitude of indirect taxes with a unified tax regime, aimed at simplifying the tax structure, reducing tax evasion, and boosting revenue. While the GST system has streamlined the taxation process and brought about many positive changes, its success heavily relies on the meticulous recording of invoices, maintaining accurate inventories, and timely filing of GST returns.

The importance of these practices cannot be overstated. Accurate invoice recording is crucial because it forms the backbone of the GST framework. Each invoice documents the transaction details between buyers and sellers, ensuring that the correct amount of GST is levied and collected. This practice not only helps in maintaining transparency but also aids in the seamless flow of input tax credits (ITC). The ITC mechanism allows businesses to reduce their tax liability by claiming credit for taxes paid on inputs, thereby avoiding the cascading effect of taxes and reducing the overall tax burden.

Maintaining accurate inventories is equally vital. Proper inventory management ensures that businesses can account for every transaction and prevent discrepancies that could lead to tax evasion or fraud. It also aids in efficient supply chain management, helping businesses to operate more effectively and respond better to market demands. Moreover, it ensures that the stock available matches the recorded transactions, which is essential for accurate GST filings.

Timely filing of GST returns is a statutory obligation for all GST-registered businesses. These returns are comprehensive documents that include details of sales, purchases, input tax credit, and tax liability. Regular filing of GST returns not only keeps businesses compliant with the law but also fosters a culture of accountability and discipline. Delayed or non-filing can lead to hefty penalties, interest charges, and even cancellation of GST registration, which can severely hamper business operations.

The government has also introduced various tools and platforms to facilitate compliance, such as the GST Network (GSTN), which serves as the IT backbone of the GST regime. Businesses must leverage these tools to simplify the compliance process. Moreover, the use of technology for real-time invoicing and inventory management can significantly reduce errors and enhance efficiency.

However, compliance is not solely the responsibility of businesses. The government must also ensure that the GST system is user-friendly and transparent. Continuous efforts to simplify the GST return filing process, providing adequate support and resources for small and medium-sized enterprises (SMEs), and addressing the technical glitches on the GSTN portal are essential steps to foster compliance.

In conclusion, the success of the GST system hinges on the active participation and cooperation of all stakeholders. Businesses must diligently record invoices, maintain accurate inventories, and file GST returns on time. By doing so, they not only comply with the law but also contribute to the nation’s economic growth. The government, on its part, must strive to make the system as efficient and user-friendly as possible. Together, we can ensure that the GST regime realizes its full potential, transforming India’s economy for the better.

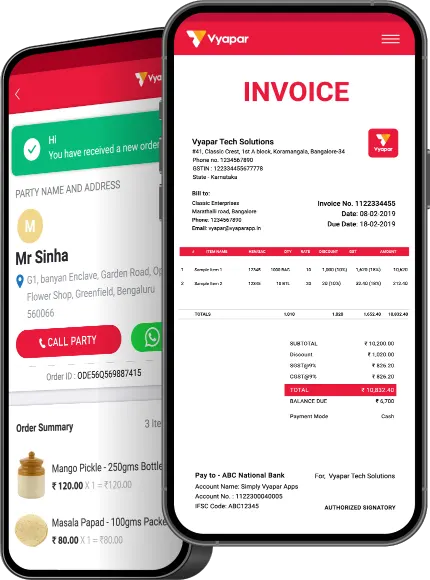

Download India’s #1 Invoicing Software.

Free Trial

Create GST Bills for customers and share them online

Create GST Bills for customers and share them online

Manage Inventory Seamlessly

Send Payment Reminders to Recover Dues

GST filing made simpler and faster

Send Estimate & Quotations

Record Expenses

Track Orders

Business Reports